GameStop Raising $1.3B of Convertible Debt for Bitcoin Purchases

Just 24 hours after adding its name to the roster of companies pursuing a bitcoin (BTC) treasury strategy, GameStop (GME) — led by its CEO Ryan Cohen — is also adding its name to those firms issuing convertible debt to raise funds for BTC acquisition.

The $1.3 billion of convertible senior notes will have a five-year maturity, according to a press release, and the underwriter greenshoe is for up to an additional $200 million.

“GameStop expects to use the net proceeds from the offering for general corporate purposes, including the acquisition of bitcoin in a manner consistent with GameStop’s Investment Policy,” the press release continued.

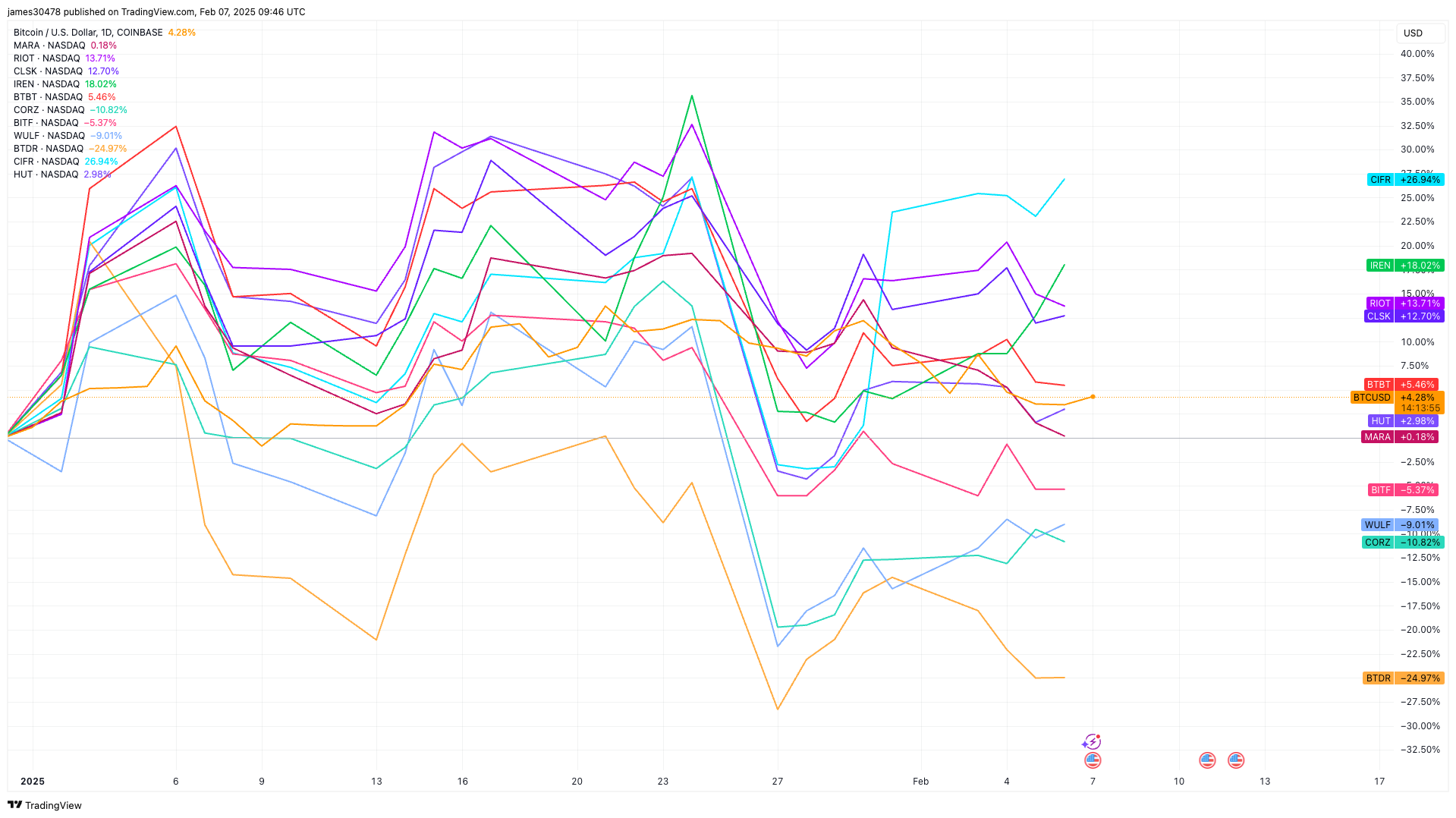

In making this move, GameStop is joining the likes of Michael Saylor-led Strategy (MSTR), Semler Scientific (SMLR), Marathon Digital (MARA) and Riot Platforms (RIOT) as those firms issuing convertible debt for bitcoin purchases.

GME shares are down 7% in after hours trading following an 11.7% advance in the regular session on Wednesday. Bitcoin appears to be bouncing off of its worst levels of the day on the news, retaking $87,000 after falling as low as $86,000 minutes ago.