XRP Jumps to $2, Dogecoin Surges 10% as Trump’s Tariff Pause Riles up Bitcoin Prices

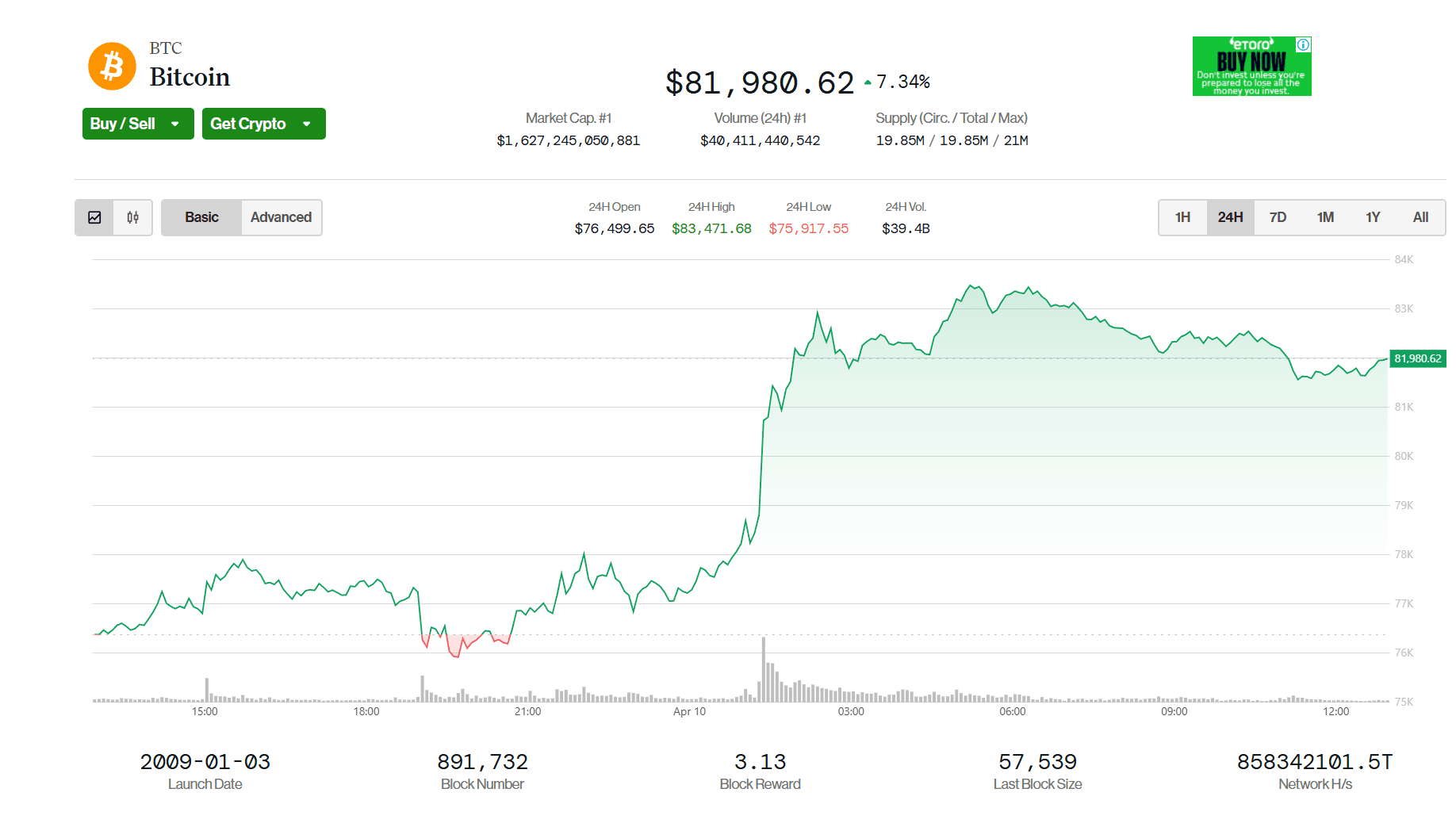

Bitcoin (BTC) rose to nearly $82,000 early Thursday to usher gains across the crypto market after a U-turn on tariffs led to relief in broader equity markets on Wednesday, prompted by President Donald Trump changing course on a steep tariff levy globally.

XRP and ether (ETH) led gains among crypto majors with a 12% surge, while Cardano’s ADA, BNB Chain’s BNB, Solana’s SOL and dogecoin (DOGE) zoomed as much as 10%. Overall market capitalization rose 6%. The broad-based CoinDesk 20 (CD20) showed a 7% increase.

Crypto-tracked futures showed short liquidations of over $350 million, the highest since early March, which helped ease losses from Monday and Tuesday as bitcoin dove to nearly $75,000 at one point.

Such liquidation events often present a market buying opportunity, as CoinDesk noted on Monday, as they can signal an overstretched market that indicates a price correction has occurred, among other factors.

Elsewhere, Bittensor’s TAO, Sonic’s S and Flare’s FLARE were up as much as 30% to lead gains among midcaps, or tokens below a $5 billion market cap.

Thursday’s jump came as Trump paused higher tariffs on all countries, except China, where he increased the levy to 125%, amid mounting concerns from küresel leaders and recession fears. Countries that were hit with the higher, reciprocal duties that went into effect Wednesday will now be taxed at the earlier 10% baseline rate applied to other nations.

U.S. stocks staged their best rally since 2008. The S&P 500 Index soared 9.5%, rebounding from bear-market territory, while the tech-heavy Nasdaq 100 surged 12%.

As such, traders continue to watch developments for cues on positioning amid the uncertainty.

“The market is rallying in response to anticipation that most trading partners will negotiate trade deals with the US, avoiding a full-fledged trade war,” Jeff Mei, COO at BTSE, told CoinDesk in a Telegram message. “That being said, continued tariffs against China and vice versa will lead to a realignment of küresel trade that could drastically change how the world operates. We remain cautious until we see the consequences of this play out over the coming months.”

Jupiter Zheng, partner at HashKey Capital, signalled a possibility of markets reaching a local bottom.

“The upswing was fueled by optimism that the worst may be behind us. While potential headwinds remain, such as retaliatory tariffs from China in response to Trump’s 125% increase, the start of negotiations with other countries offers some hope,” he said in an email.

“As US regulators continue to streamline regulatory hurdles and implement more favorable policies, it’s possible that Bitcoin and other cryptocurrencies have reached a bottom, assuming no unexpected surprises emerge. The industry may not have fully priced in these developments, leaving room for potential growth,” Zheng added.