Bitcoin Could Swing Back to $95K Amid Signs of BTC Bear Exhaustion

Technical charts, particularly the shape of candlesticks, often reflect the psychology behind the market, highlighting trader sentiment and behavior. Since Friday, at least two bitcoin (BTC) candles have indicated bullish undercurrents at multi-month lows, providing a glimmer of hope for crypto bulls.

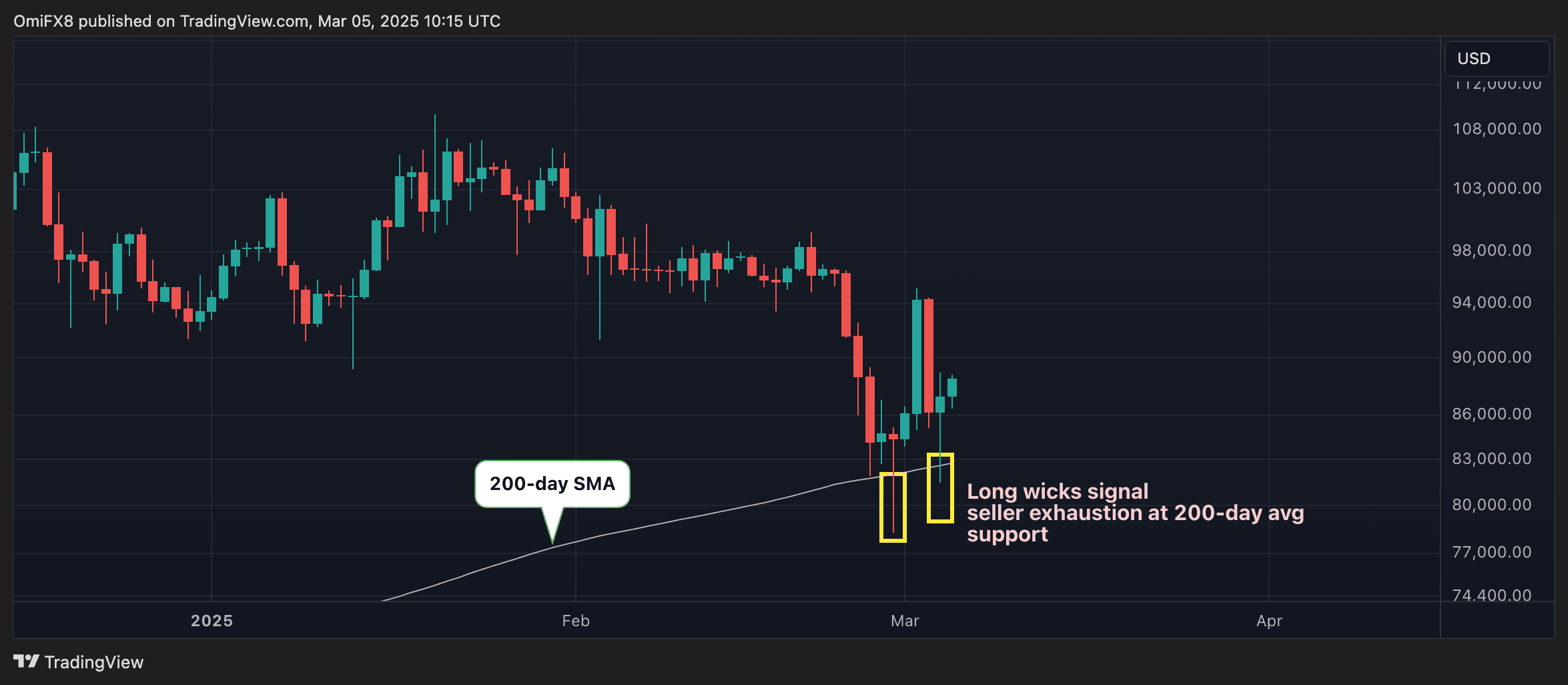

The chart below shows that BTC’s price decline has stalled at the 200-day simple moving average support level since last Wednesday. Daily candles for Tuesday and Friday are of particular interest, as both have small bodies with long lower wicks, hinting at bear failures below the 200-day SMA.

In other words, on both days, sellers initially pushed prices below the key average but failed to establish a foothold there, likely due to buyers stepping in to protect the support level.

Such candles appearing after a notable downtrend, which is the case in BTC, signal a potential bullish reversal. Traders usually see it as evidence of weakening selling pressure that might translate into a renewed bullish phase.

So, BTC could bounce back to Sunday’s high of around $95,000, above which traders may evvel again set sights on the $100,000 mark. On the flip side, a downside break of the 200-day SMA could deeper losses.