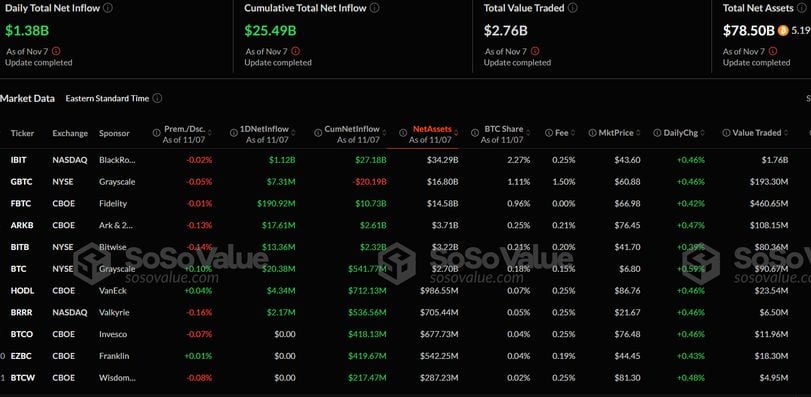

Bitcoin ETFs See Record $1.3B Inflows on Trump Win, Fed Rate Cuts

Bitcoin (BTC) exchange-traded funds (ETFs) listed in the U.S. logged a record $1.38 billion in net inflows on Thursday, a day after Republican Donald Trump won the U.S. presidency.

BlackRock’s IBIT took on over $1.1 billion in net inflows, the most among all products, and its highest-ever since going live in January. Cumulative net inflows across all products crossed $25 billion for the first time. None of the twelve ETFs showed any net outflows.

Ether (ETH) ETFs logged $78 million in net inflows on renewed bullishness for the decentralized finance (DeFi) space following Trump’s victory. ETH rose more than 10% on Thursday as expectations of pro-crypto policies and deregulation in a Trump regime boosted investor confidence in the asset.

BTC trades above $76,000 in Asian morning hours Friday, up nearly 10% over the past week. In line with analyst expectations, the Federal Reserve cut rates by 25 basis points on Thursday in a move that typically supports risk assets like bitcoin by increasing liquidity and weakening the dollar.