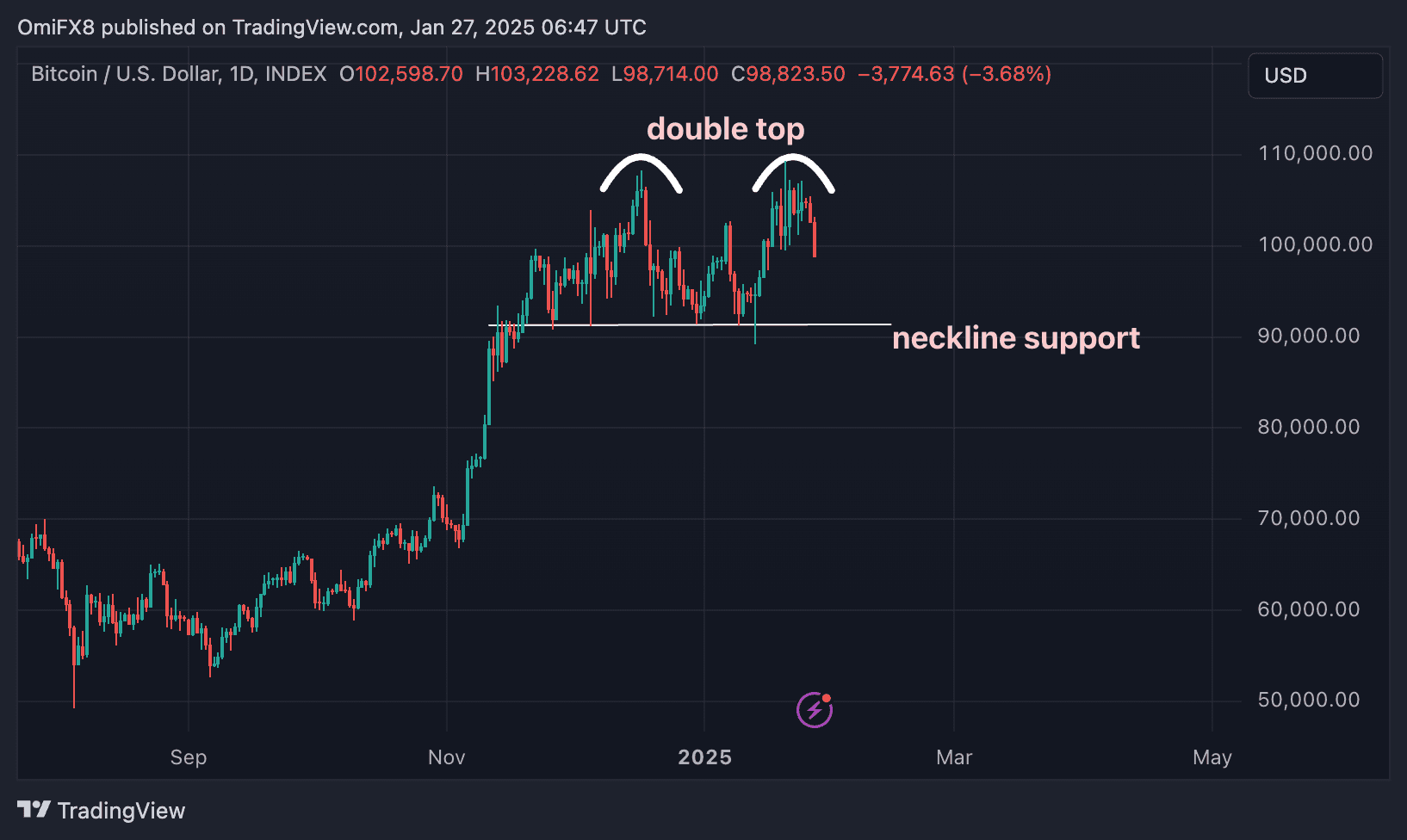

Bitcoin May Be ‘Double Topping’ for a Price Slide to $75K

Bitcoin (BTC) may drop to $75,000 should it trigger a so-called ‘double top’ bearish reversal pattern.

A double top comprises two consecutive peaks at approximately the same price, with a trendline drawn through the low point between these peaks. The failure to break above the previous peak, followed by a subsequent decline, suggests that the uptrend is losing momentum.

So, an eventual breakdown of the horizontal trendline support, the double top neckline, is said to confirm a bullish-to-bearish trend change.

BTC has pulled back to $100,000 at the time of writing, having failed to maintain a foothold above the December high last week. In other words, BTC looks to have formed a double top, with neckline support positioned around $91,300.

A UTC close below the neckline level would confirm the bearish reversal pattern, potentially triggering a decline to $75,000. This target is calculated using the measured move method, subtracting the gap between the twin peaks and the neckline from the neckline level.