Chart of The Week: Will April Bring Good Luck or Fool’s Hope for Bitcoin?

It’s a bloodbath for digital assets, with traders hitting the sell button, wiping out over $160 billion of the total cryptocurrency market cap since Friday.

Few things have compounded as the first quarter of this year closes out, leading to the sell-off, including Trump’s tariff threats, küresel economic concerns and the lack of a clear catalyst for the next leg up.

However, if history is anything to go by, there might be some glimmer of hope heading into the second quarter, as April could bring a bullish setup for crypto.

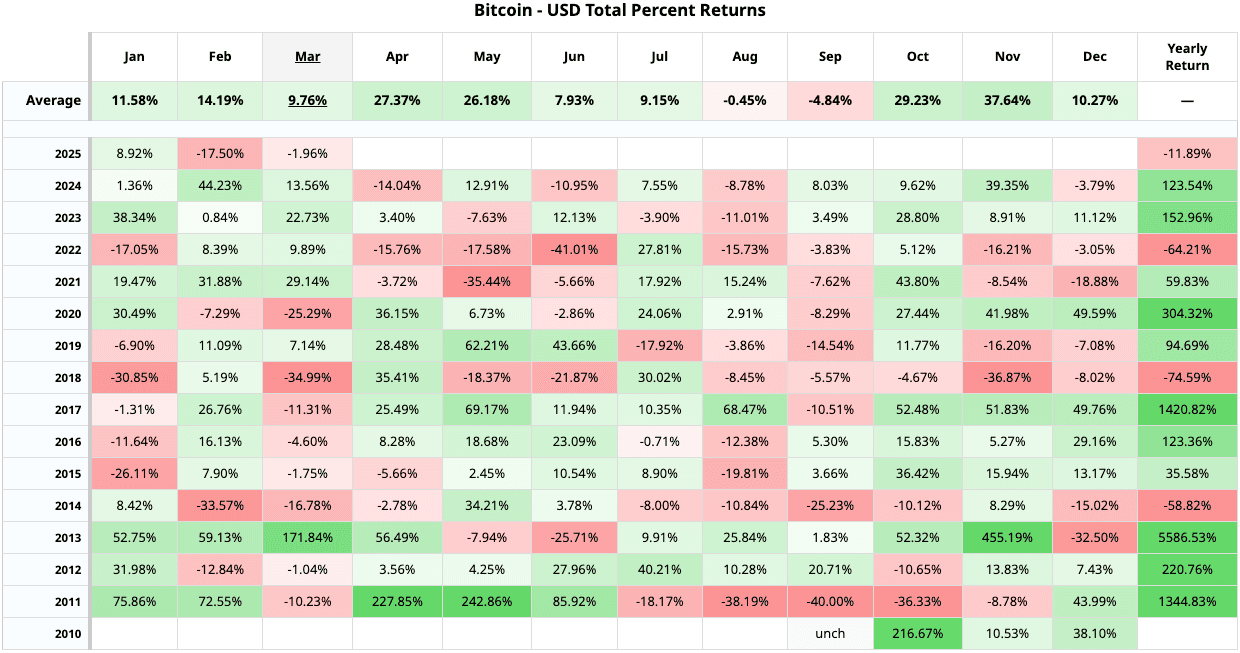

Based on the total percent return since 2010, April has brought in an average 27% return for bitcoin, marking it the third-best month, according to Barchart veri. November and May were the other two months with the highest returns, with about 38% and 26% gains, respectively.

As CoinDesk analyst Omkar Godbole reported for Crypto Daybook Americas—a premium newsletter offering to help traders make informed investment decisions—this seasonality could be a much-needed positive indicator for the market.

“Seasonality factors are not as reliable as standalone indicators, but when coupled with other signs, such as the recent halt in selling by long-term holders, they appear credible,” Godbole wrote.

One cog in the wheel may be the defunct exchange Mt. Gox’s transfer of a significant amount of bitcoin to the centralized exchange’s wallets, which could create fear of creditors’ liquidations.

“A potential short-term risk is Mt. Gox, which has been transferring sizable amounts of BTC to Kraken—this may lead to temporary selling pressure or market volatility,” said Deribit CEO Luuk Strijers.