Circle’s EURC Stablecoin Surges 43% to Record Supply as Dollar Troubles Fuel Demand

Circle’s euro-backed stablecoin, EURC, surged to a record supply as mounting U.S. trade tensions and a weakening dollar likely fuel demand for euro-denominated digital assets.

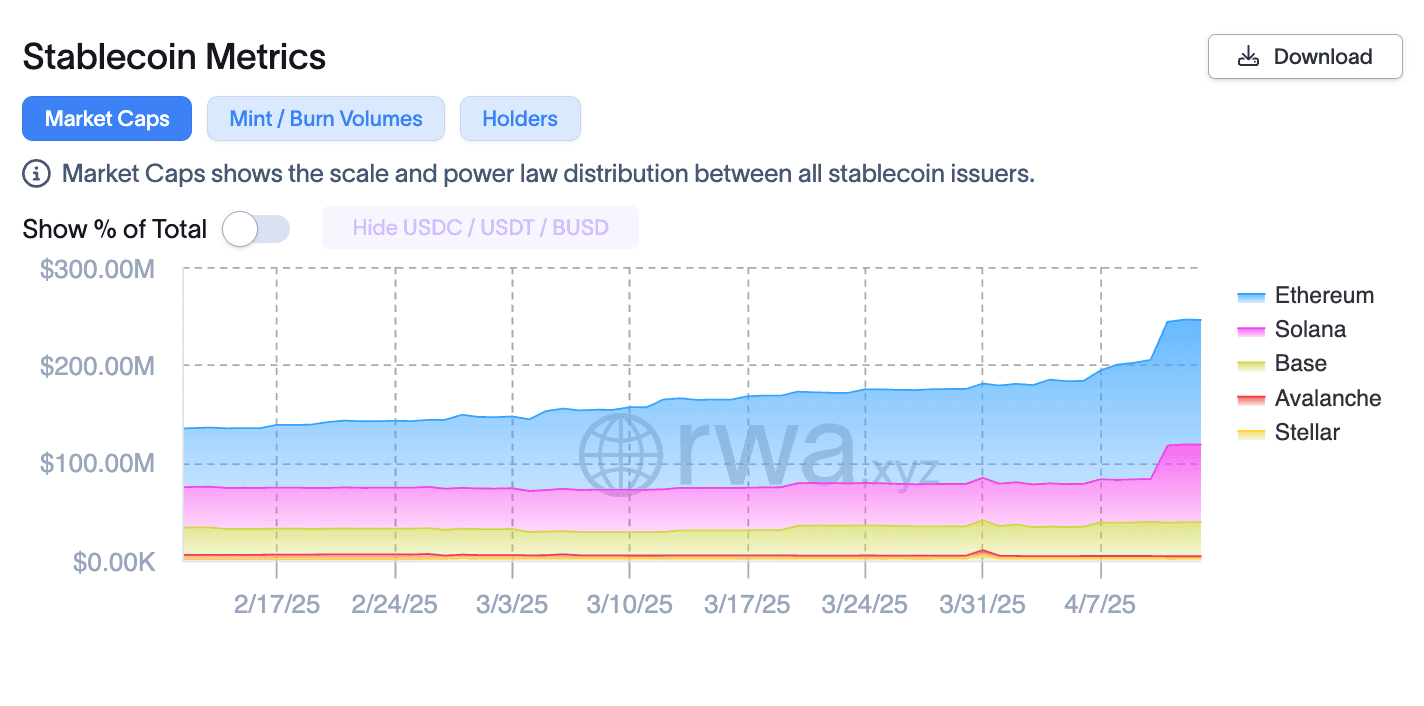

EURC’s supply grew 43% over the past month to 217 million tokens worth $246 million, ranking above Paxos’ Küresel Dollar (USDG) and below Ripple’s RLUSD by market capitalization, RWA.xyz veri shows. Most of the EURC tokens circulate on the Ethereum network, up 35% in a month to 112 million, while Solana saw the fastest, 75% expansion to 70 million tokens. Base, Coinbase’s Ethereum layer-2, also saw a 30% growth to 30 million in EURC supply.

The token also experienced an uptick in on-chain activity, with active addresses rising 66% to 22,000 and the monthly transfer volume surpassing $2.5 billion, up 47% in a month, per RWA.xyz.

EURC is currently the largest euro stablecoin on the market, but it lags far behind its dollar-denominated counterparts. Dollar-pegged stablecoins make up 99% of the rapidly growing stablecoin market, led by Circle’s $58 billion USDC and rival Tether’s $143 billion USDT token.

The accelerating growth of EURC could be a sign of growing demand for diversification to euro-denominated digital assets, particularly as küresel investors navigate increasing economic uncertainties in the U.S. with the Trump administration wide-scale tariff rollout. The greenback weakened 9% against the euro since the start of the year.

Xapo Bank, a Gibraltar-based Bitcoin-focused financial services firm, reported Monday a 50% increase in euro deposit volumes during the first quarter, outpacing the 20% rise in USDC stablecoin deposits. Meanwhile, deposits in USDT declined by over 13%.

“This rapid increase in volume came amidst mounting concern about the future of U.S. dollar primacy and the threat of a U.S. recession as markets braced for Trump’s planned ‘Liberation Day’ in April,” the firm said in the report.

Stablecoin swap volumes between foreign currency pairs on Ethereum-based decentralized exchanges also soared to multi-year highs last week, dominated by the EUR-U.S. dollar pair, Blockworks veri showed.

EURC also has likely benefited from Tether’s withdrawal of its euro-backed stablecoin (EURT) with E.U.-wide MiCA regulations going into effect this year, while a number of exchanges delisted USDT for E.U. users to comply with regulations, including Binance at the end of March.