Gold Continues Correcting and That Might Be Good for Bitcoin

What may or may not have been a blow-off top last week in the price of gold appears to have benefitted bitcoin (BTC) and that trend could be set to continue.

Already among the best-performing küresel assets in recent months, gold’s rally powered to new heights in the weeks following President Trump’s Liberation Day tariffs in early April.

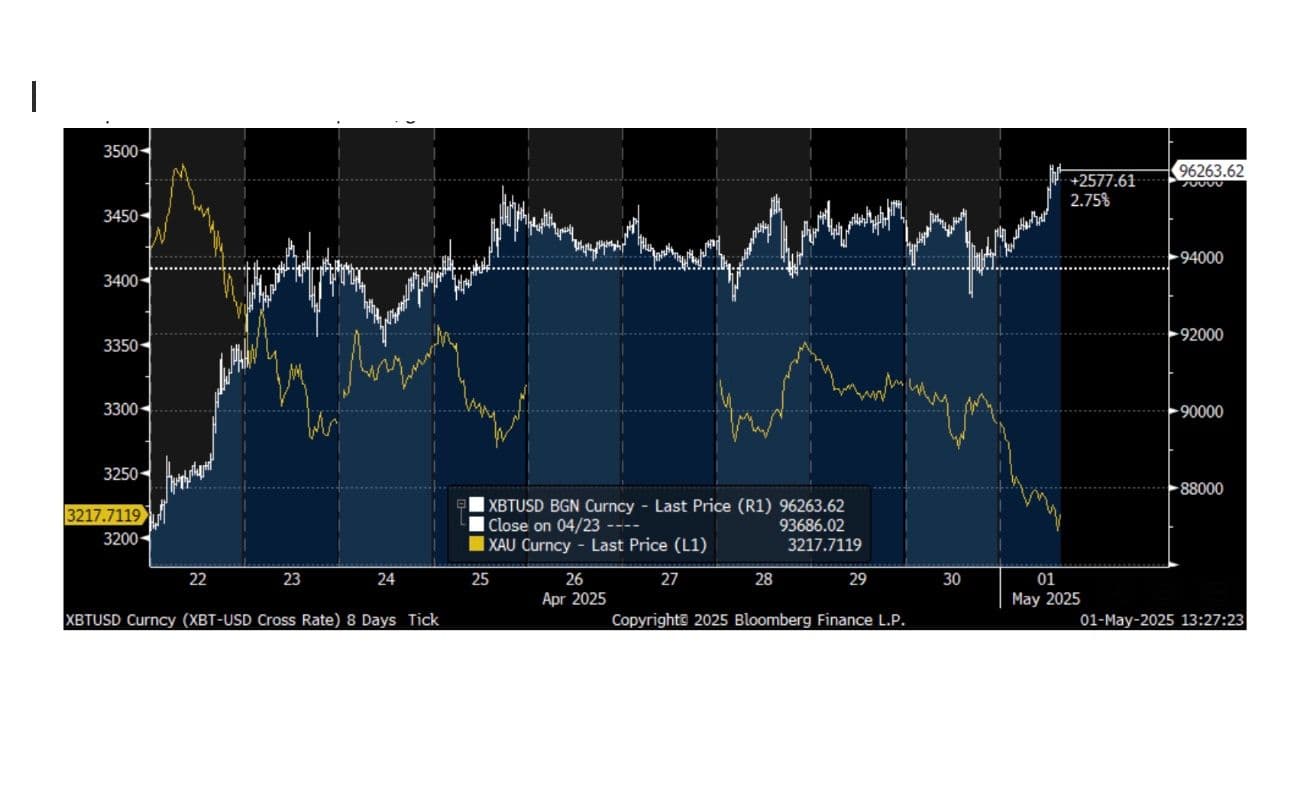

The price ultimately peaked above $3,500 per ounce on April 21, with bitcoin at the time changing hands at $87,000 — roughly flat from Liberation Day, but lower by about 20% from its record high hit in January.

Since, though, gold has tumbled nearly 10% to its current price just above $3,200 per ounce. At the same time, bitcoin has rallied about 10% to a two month high of $97,000.

“I think bitcoin is a better hedge than gold against strategic asset reallocation out of the U.S.,” said Standard Chartered’s Geoff Kendrick.

Kendrick took note that the ETF inflow situation has flipped along with the price, with money headed into bitcoin funds surging past that headed into gold funds.

Further, said Kendrick, the last time bitcoin ETF inflows had such a wide margin over gold was the week of the U.S. presidential election. Two months later, the price of bitcoin had risen more than 40% to above $100,000.