Metaplanet Announces Largest Raise by an Asian-Listed Firm to Buy Bitcoin

Metaplanet (3350), the Japanese hotel investor, has announced the largest capital raise in Asian equity market history to buy bitcoin (BTC).

Metaplanet has issued 21 million shares through 0% discount moving strike warrants, raising approximately 116 billion yen ($745 million). This allows holders to buy shares at an exercise price equal to the market price, minimizing dilution for existing shareholders.

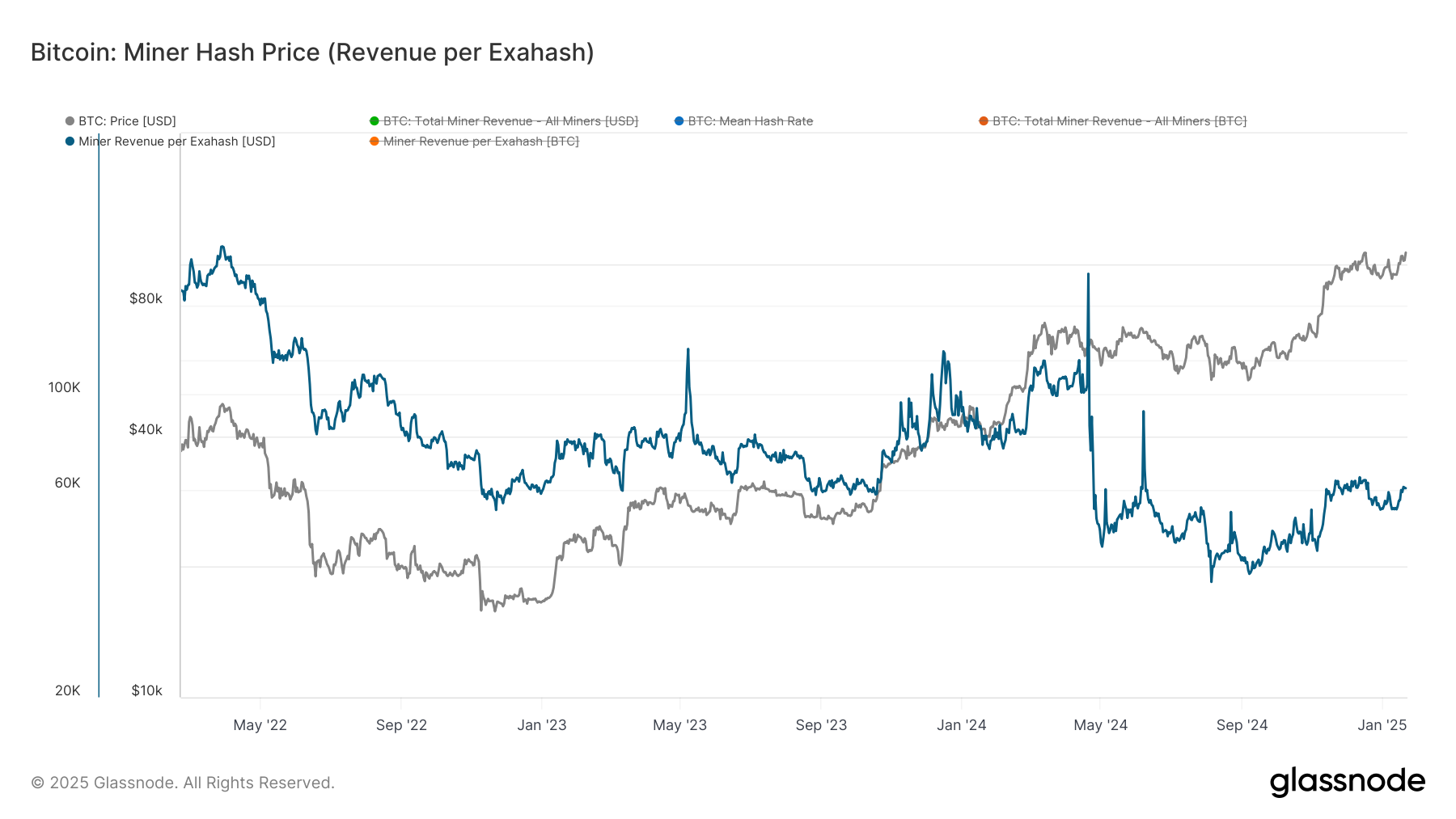

The issuance is part of the company’s “Bitcoin-first, Bitcoin-only” strategy, which aligns with its plans to continue increasing its bitcoin holdings amidst the yen’s devaluation and Bitcoin’s all-time high.

The stock acquisition rights were issued at 363 yen per unit ($2.33) and have adjustable exercise prices based on market value.

Metaplanet is the fifteenth largest publicly traded bitcoin holder, with 1,762 BTC. It closed 3% higher on the day, and its shares are up 16% year-to-date.

Disclaimer: This article, or parts of it, was generated with assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.