MicroStrategy Buys 1,070 BTC, Plans to Raise Up to $2B Through Preferred Stock Offering

Disclaimer: The analyst who wrote this piece owns shares of MicroStrategy (MSTR).

MicroStrategy (MSTR) has increased its bitcoin (BTC) holdings for the ninth consecutive week.

MicroStrategy holds more bitcoin than any other publicly traded company. In the week ending Jan. 5, MicroStrategy purchased a further 1,020 BTC for $101 million, bringing its total bitcoin holdings to 447,470 BTC.

It wouldn’t be a Sunday without Executive Chairman Michael Saylor teasing the announcement in a post on X. The average purchase price of the bitcoin was $94,004, which raised the average price to $62,503.

The latest bitcoin purchase was funded through share sales under the company’s at-the-market (ATM) program, for which they have $6.77 billion left on the ATM program.

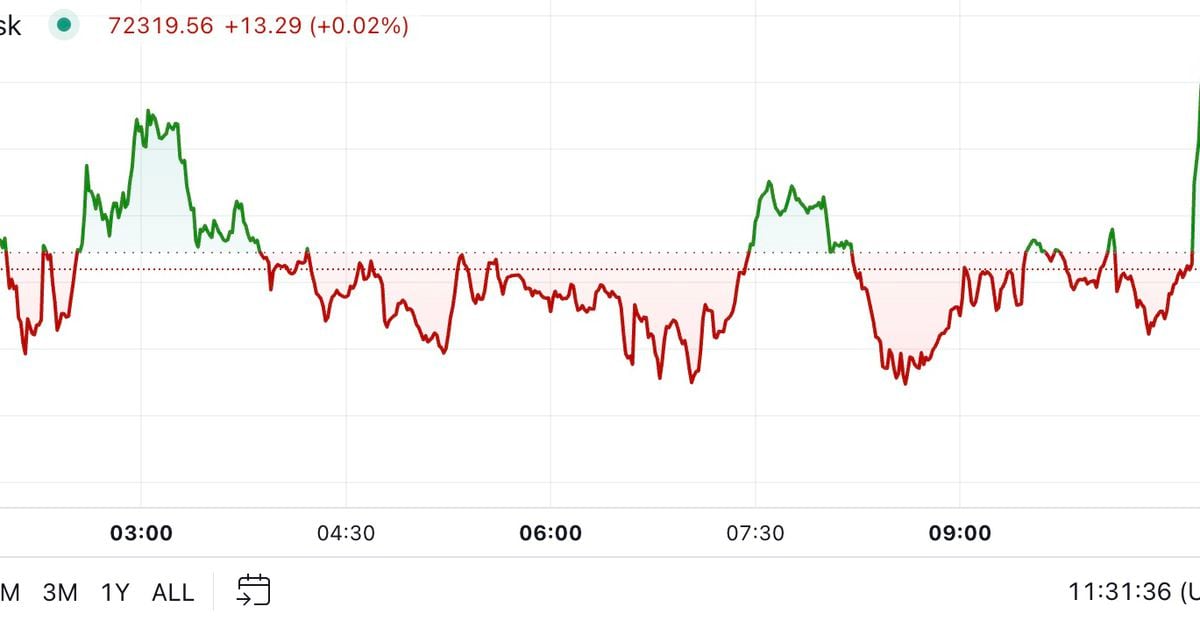

The share price recovered on Friday with a 13% gain after an almost 50% drop from the Nov. 21 high of $543, while the stock is trading around $353 — 2% higher — in pre-market trading.

In addition, MicroStrategy announced it would be raising up to $2 billion via a preferred stock offering. This $2 billion offering sits separately to the 21/21 plan of $21 billion in equity and $21 billion in fixed income.

Preferred stock takes precedence over Class A common stock. In the filing, some features include convertibility to Class A common stock, payment of cash dividends and provisions allowing for the redemption of shares. The perpetual preferred stock and price offering terms have yet to be determined, while the offering is expected to occur in Q1 2025. The purpose of the offering is for MicroStrategy to acquire more bitcoin.