Market

Recent U.S. regulatory filings are show a broadening in the base of buyers for bitcoin ETFs.

The NFT market has failed to reach the dizzying heights of 2022, but maybe it doesn’t need to.

Ether’s brief run to $2,850 on Monday was due to a catch-up trade that could reverse later, one trader said.

Bitcoin’s lackluster price action may receive a jolt from this week’s macroeconomic calendar.

Traders continue to position for price gains through options even as BTC trades listless below $100K.

The new Liquid Yield Tokens (LYT) offer a floating value based on DeFi funds, starting with Edge Capital, RE7, and MEV Capital.

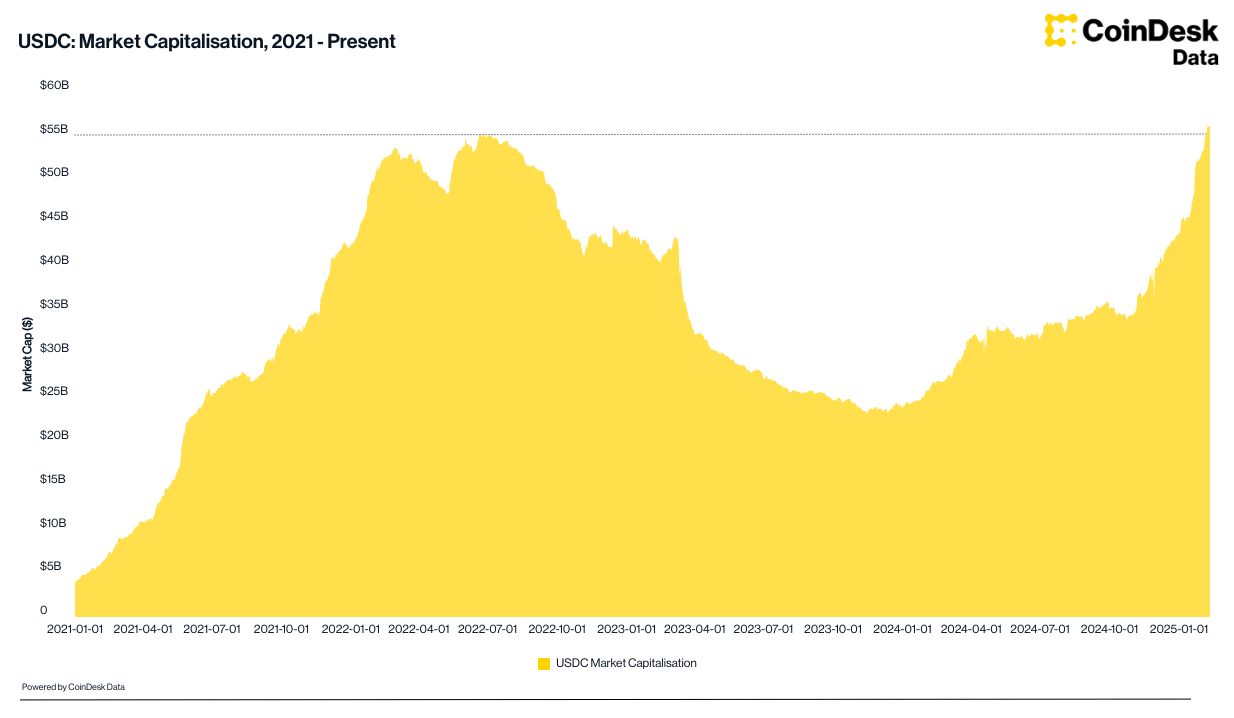

USDC and USDT minting accelerated in the past weeks, providing a bullish signal for crypto markets despite declining token prices.

The move comes after Securitize linked to Solana to bring tokenized real-world assets to the network.

Some traders expect a dollar unwind on any indications of a rate cut — which could bump risk assets and provide an entry for crypto investors looking to bet on higher prices.

ETH, DOGE Price Analysis: How Trump Tariffs May Impact Cryptos Such as Ether, Dogecoin