Market

Strong job growth can lead to fears of inflation and increased interest rates, while weak veri might signal an economic slowdown.

VanEck predicts M2 money supply will grow to $22.3 trillion by 2025 from the current $21.5 trillion, boosting crypto markets and top tokens such as SOL.

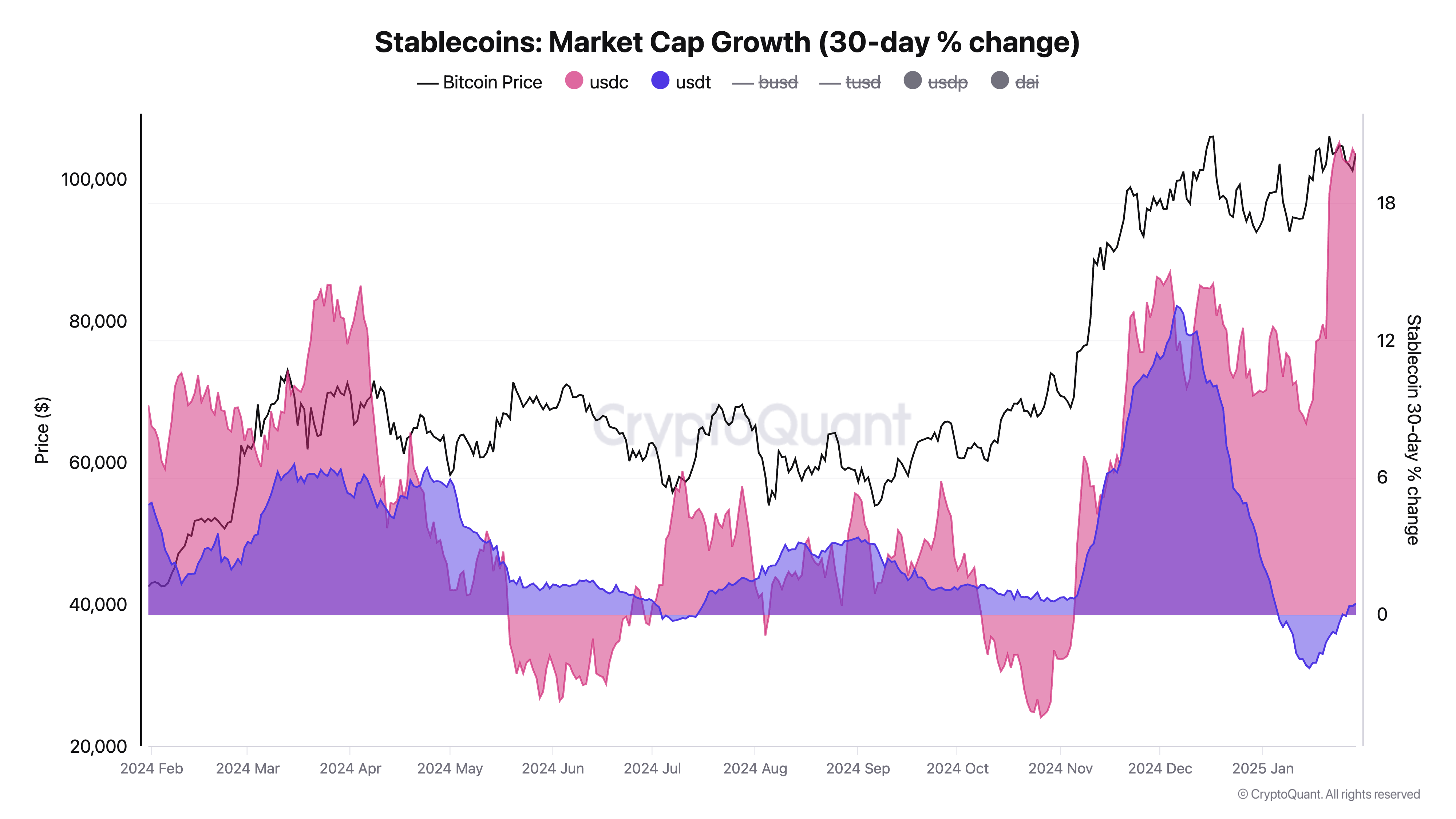

The stablecoin market has grown by almost $40 billion since President Trump won the U.S. election.

BTC takes a breather as Trump’s tariff threat bodes well for gold, and the uptick in Tokyo inflation supports BOJ rate hikes.

Bitcoin added 4% in the past 24 hours to trade around $103,000 in European morning hours, alleviating some of Monday’s losses.

On Monday, NVIDIA had the largest single-day market cap loss in history, erasing $465 billion in market cap.

Wintermute has launched a CFD tied to the GMUSA index, providing an easier way for traders to bet on the U.S. strategic crypto reserve.

The selloff could provide traders an attractive entry opportunity in higher-beta altcoins such as Solana’s SOL, which endured a double-digit pullback, one analyst said.

Maybe it’s time to trust the stars as the year of the snake starts.

Traders of BTC-tracked products lost $238 million in the past 24 hours, majorly in early European and Asian afternoon hours.