Market

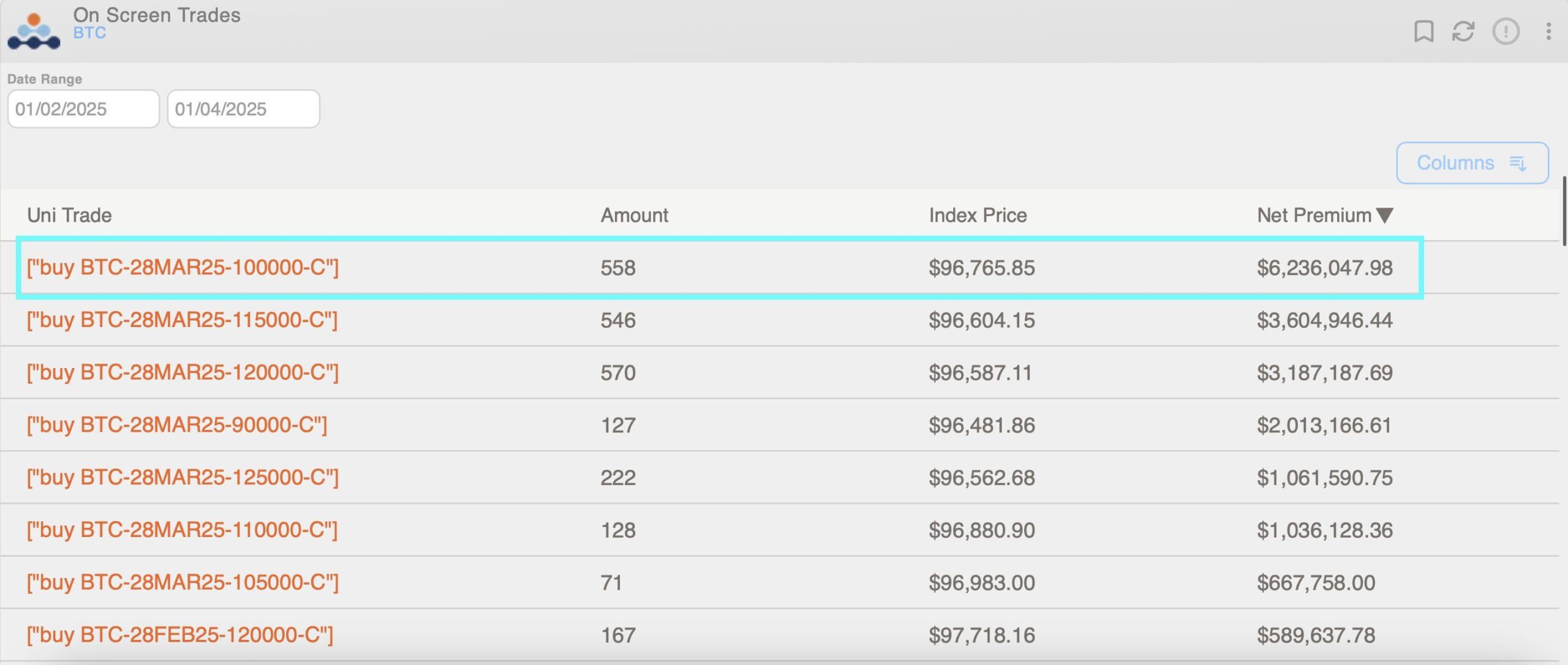

Traders are positioning for a rally to record highs after President-elect Donald Trump takes office on Jan. 20

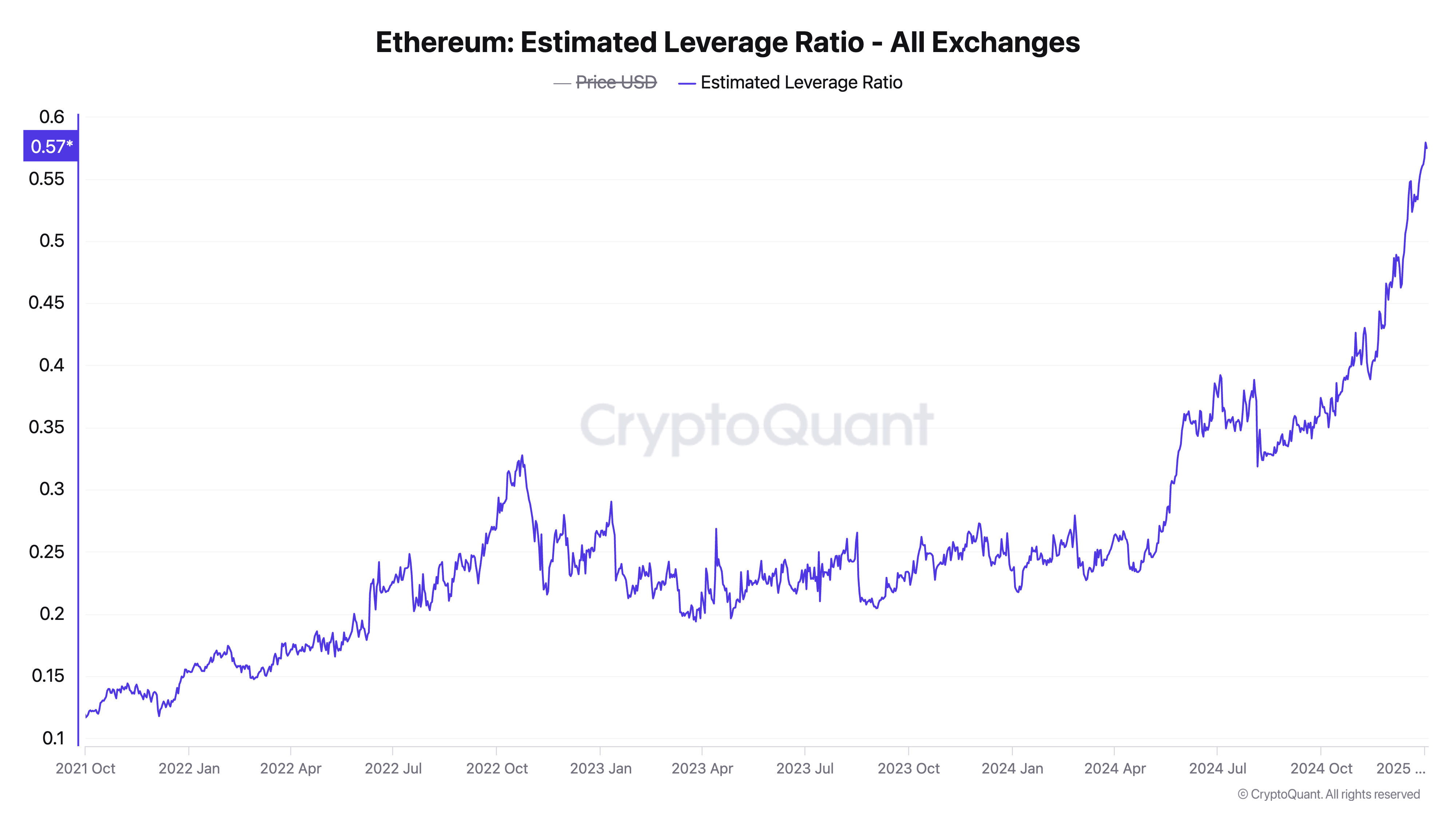

Ether stands out relative to BTC as the go-to major currency for traders looking to amplify returns with the use of leverage

BTC’s rally has stalled amid hawkish comments from the Fed officials.

“We believe that the underlying strength in BTC represents a systematic shift in the market in anticipation of Trump’s return to office,” QCP Capital traders said in a Friday broadcast.

Ethereum is by far the most popular blockchain for issuers of tokenized traditional assets with a current market cap of $1.6 billion.

The crypto custodian’s clients can use money market fund tokens as collateral in derivatives trades after the company received approval from the Financial Services Regulatory Authority (FSRA) in Abu Dhabi.

Headline inflation year-over-year is expected to increase by 0.2% and end a six-month consecutive decline, last seen in March 2024.

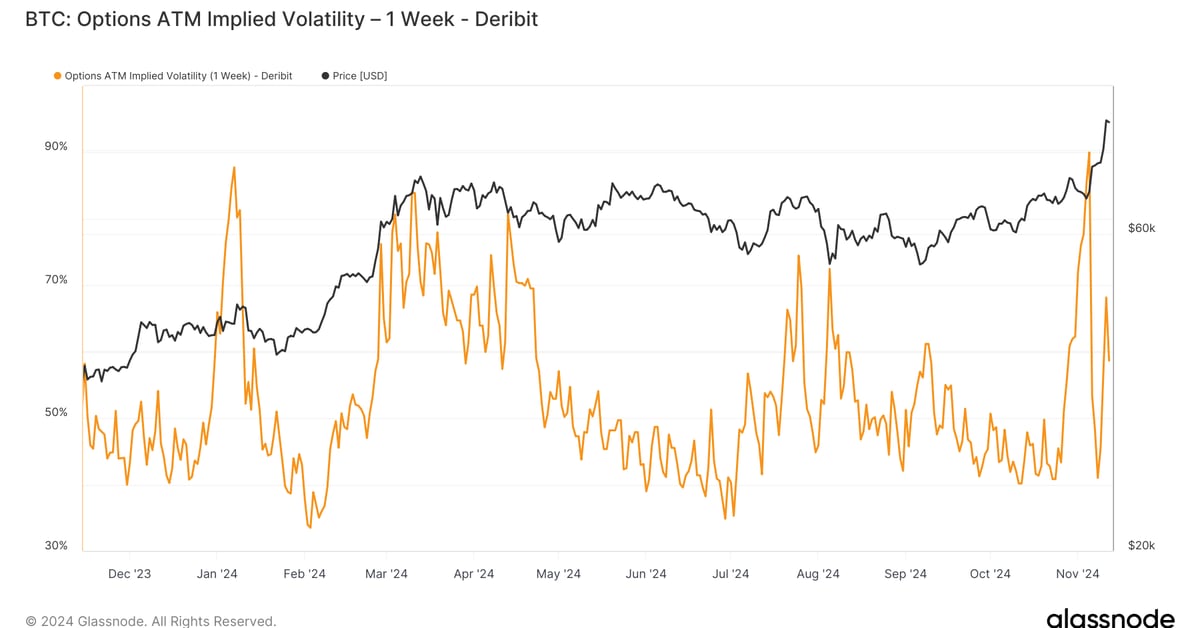

BTC’s breakout has the market in a state of euphoria, QCP Capital said.

Michael Saylor’s company surpassed its lofty dotcom bubble highs, now holding over $24 billion worth of BTC in its treasury.

The token has risen amid an absence of liquidity on exchanges.