Price

Traders of BTC-tracked products lost $238 million in the past 24 hours, majorly in early European and Asian afternoon hours.

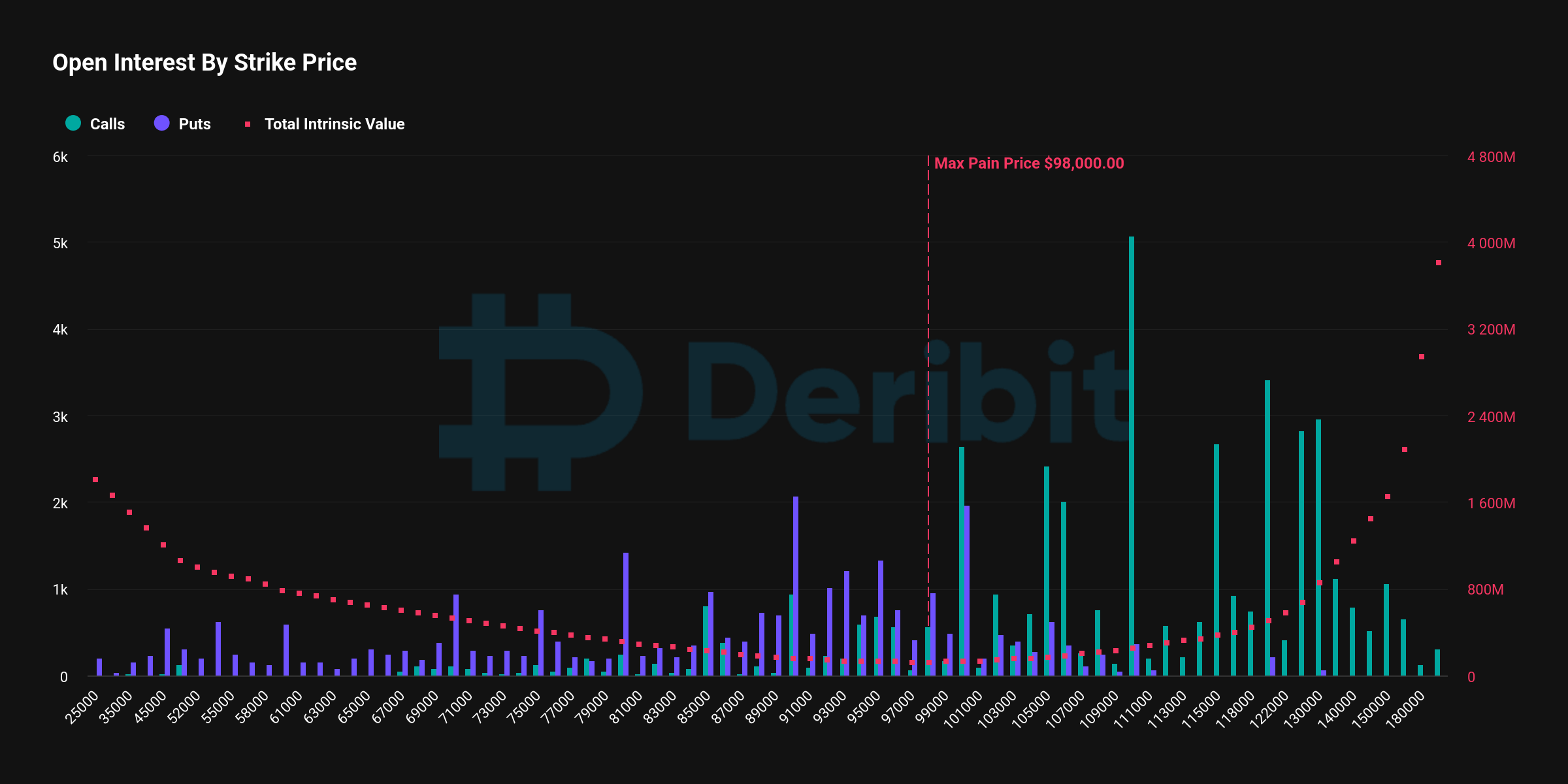

Some $6 billion of the notional value in bitcoin is currently set to expire out of the money.

Volatility bulls might want to pull up the 60-day price range indicator on their screens as it’s hinting at heightened BTC price turbulence.

The küresel investment management firm plans to launch two similar funds in February.

Implied and realized volatility indexes hit the highest levels since August’s yen carry trade unwind.

Wednesday’s soft U.S. core CPI has opened doors for traders to focus on Trump’s swearing in and the possibility of first-day pro-crypto announcement.

XRP’s price rise is accompanied by record perpetual futures open interest and surge in trading volumes.

BTC’s latest price action seems to contrast sharply with the uptrend exhaustion observed at record highs above $108K in mid-December.

BTC neared $95,000 in European morning hours Friday after a slump in U.S. hours sent it to near $90,000 late Thursday, down 10% from a weekly high above $120,000.

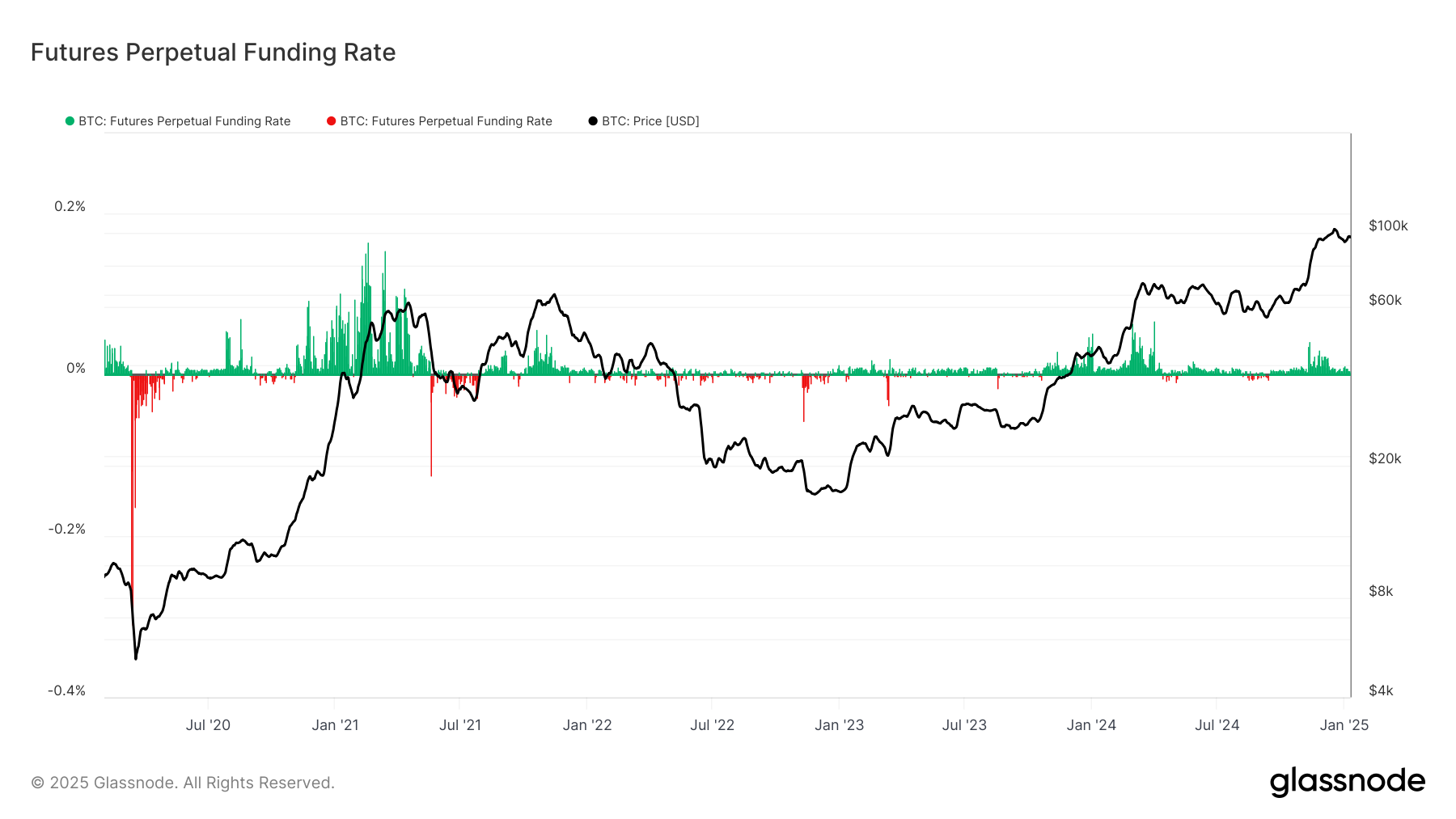

Glassnode veri shows that the perpetual funding rate went negative for the first time in 2025.