Trump

An indicator called the cumulative volume delta shows traders are either shorting perpetual futures or closing long positions.

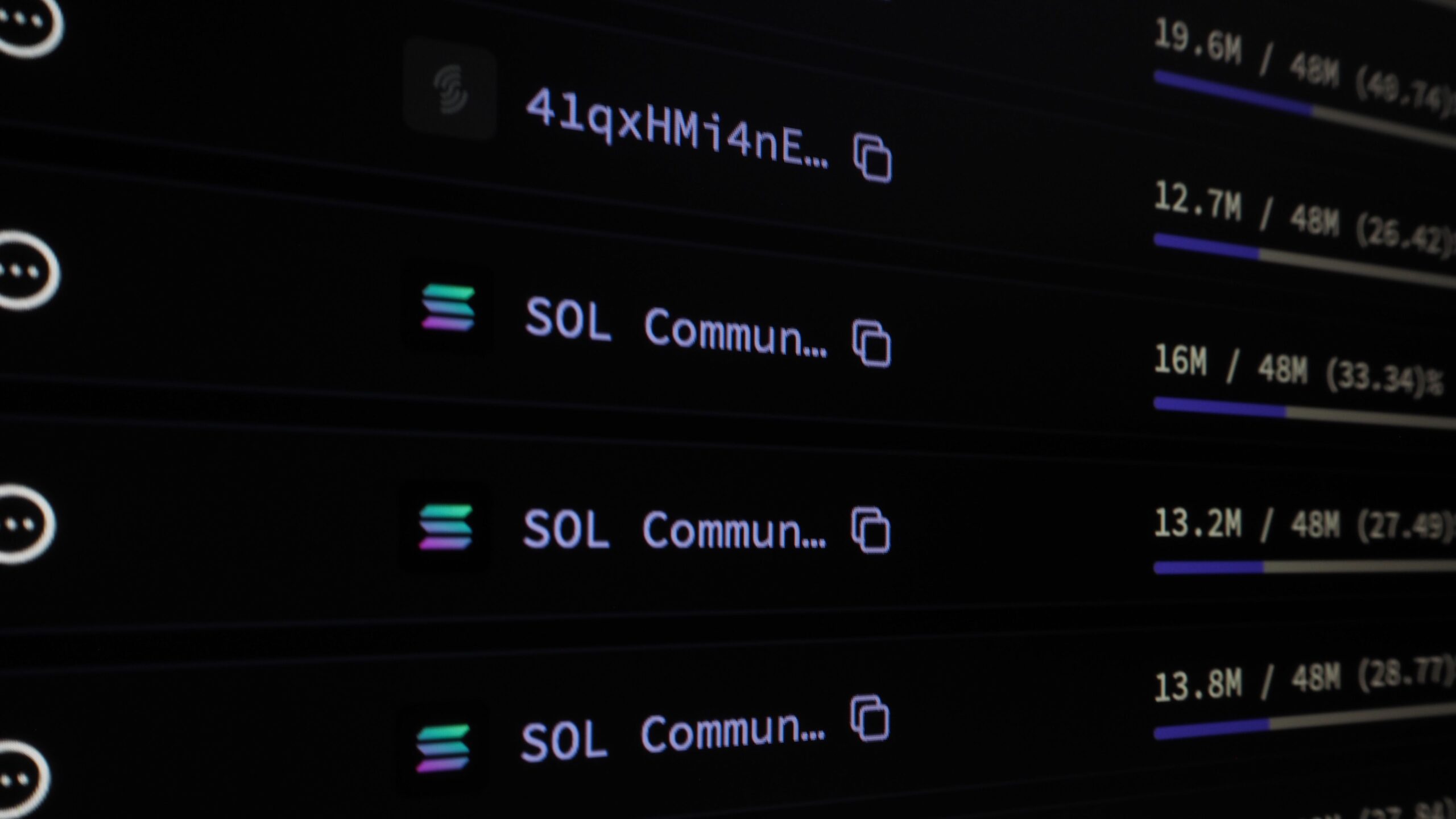

Such fees are remarkably high for a low-cost blockchain, when transactions typically take fractions of a cent to settle.

BTC has pulled back to $100K as Melania Trump launched her own memecoin, stalling the surge in the TRUMP token.

The launch of Donald Trump’s official memecoin on Solana has not only boosted the cryptocurrency’s price and trading volume, but also perceived odds of a SOL ETF.

Donald Trump’s official memecoin hit $44 early Sunday, up more than 900% over the past 24 hours.

The official memecoin of the 47th United States president will be listed on most major crypto exchanges, even though the fan token faced trouble getting listed.

Trader demand for Solana’s SOL rose as Donald Trump’s so-termed official token was issued on the network.

Prices ran from few cents to $14 in less than six hours amid widespread confusion on whether the token was actually backed by Trump or was a possible hack of Trump’s verified social account

Crypto leaders attended a pre-inaugural bash in Washington, cheering Trump’s return to the White House and hoping it will benefit digital assets.

The campaign-financial operation that shook the 2024 elections has returned to dabble in Florida congressional seats vacated by Matt Gaetz and Michael Waltz.