Stablecoin

Circle’s euro-backed stablecoin, EURC, surged to a record supply as mounting U.S. trade tensions and a weakening dollar likely fuel demand for euro-denominated digital assets. EURC’s supply grew 43% over the past month to 217 million tokens worth …

Cap, a yield-bearing stablecoin protocol, shared Monday that it has raised $11 million in funding from big-name financial institutions including Franklin Templeton and Triton Capital. The total funding — announced at the close of a recent $8 million …

Tether, issuer of the world’s largest stablecoin USDT, may offer a new token specifically for the U.S., according to a Financial Times report on Monday. Paolo Ardoino said the company had been involved in discussions about the U.S. rules on …

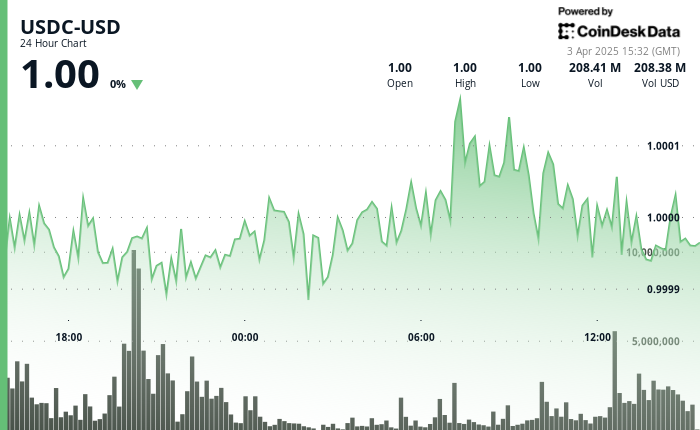

USDC at Center of Major Financial Developments Küresel economic tensions and shifting trade policies are creating subtle ripples in the stablecoin market, with USDC experiencing minor volatility while maintaining its dollar peg. The stablecoin …

Itaú Unibanco, Brazil’s largest bank by assets, is exploring whether to issue its own stablecoin as regulatory discussions evolve and U.S. financial institutions slowly move into the sector. The decision could hinge on how American institutions fare …

U.S. stablecoin legislation took another major step on Wednesday as a House of Representatives committee joined Senate counterparts in advancing a bill to be considered by the overall House, bringing stablecoin regulations closer to reality. Eventual …

Ripple, an enterprise-focused blockchain service closely tied to the XRP Ledger (XRP), said on Wednesday it has integrated its stablecoin to the company’s cross-border payments system to boost adoption for Ripple USD (RLUSD). Select Ripple Payments …

The market capitalization of tokenized gold climbed to a record $1.4 billion in March with trading volumes soaring to yearly highs, CoinDesk Data’s monthly stablecoin report shows. The growth in market value and activity happened alongside the …

Intercontinental Exchange, the parent company of the New York Stock Exchange, said it plans to explore using Circle’s stablecoin and tokenized asset to develop new products, joining a roster of U.S. traditional financial giants pushing into crypto …

TradFi giant Northern Trust (NTRS) will provide custody and cash management services for trade finance focused stablecoin issuer Haycen, the company said in a press release Thursday. Northern Trust Asset Servicing will be responsible for providing …